buy borrow die explained

The house value is now 20 million due to appreciation. Youd have read about it if you have any interest in how rich people in the west manage their money.

List Of Regular And Irregular Verbs Irregular Verbs Regular And Irregular Verbs Verb

Origin of Buy borrow die McCaffery came up with Buy borrow die in the mid-1990s to help students understand how the wealthy avoid paying taxes.

. And talent that was previously borrowed may make sense to eventually buy. It is a simple three-step process that helps the rich stay rich and live lavishly without wasting a penny on taxes. This video is part.

Thanks to Policygenius for spons. Banks say their wealthy clients are borrowing more than ever before often using loans backed by their portfolios of stocks and bonds. When you die your estate goes to your heirs.

Buy borrow die. For all who seeking for buy borrow die explained images information related to your interest you have to come to the ideal website. The focus of the ProPublica article was billionaires borrow against their wealth as a long-term strategy which brings on a lot more risk and could be cost-ineffective.

Another way to avoid paying taxes is the buy borrow die strategy. Borrow money against it its considered debt so you pay no taxes Put that money in a trust. Edward McCaffery a professor at the University of Southern California Gould School of Law coined the phrase buy borrow die.

In fact for California residents you can currently borrow at 0 APR. Buy Borrow Die. The public thinks the.

Its all based on a quirk in their tax code that is fundamentally different than Canadian tax. The goal is to not sell your assets and pay taxes. Youre probably thinking Buy Borrow Die doesnt work because I will have to pay that debt at some point so I will eventually have to sell and pay taxes then Never fear creditors favor the.

Borrow from her 401k at an interest rate of 4. How Americas Ultrawealthy Stay That Way Click to expand. Once youre already rich its simple.

Assuming that your stock keeps appreciating you can keep up the buy and borrow as opposed to buy and sell strategy for the rest of your life always keeping maximum control of your. Yes its promotional - but thats amazing. The loans are paid off with the assets and then the assets get a step-up in cost basis when they pass to your heirs.

588K subscribers Subscribe Some of the wealthiest Americans use a strategy called Buy Borrow Die to dramatically reduce their tax bills while their fortunes continue to grow. Or they can borrow talent. Its an intriguing concept that explains one.

BuyBorrowDie works with low. BuyBorrowDie works with low interest rates high investment returns limited legislative focus Generally speaking the last 20 years has provided optimal conditions for this. As of the writing of this article the proposed tax plan would raise the capital gains tax rate from 238 to 434.

Buy borrow and die is one conceptual approach to tax planning. It would also cause capital gains above the 1 million exemption. Regarding to Buy Borrow Die Explained.

But this has been true for 100 years. To start comparing quotes and simplify insurance-buying check out Policygenius. The strategy could really be renamed Buy Hold Borrow Die because the key requirement for it to work is to hold the asset throughout your life without ever selling any.

Its a strange name for a way of handling money. We call this maneuver Buy Borrow Die.

Big Ideas Simply Explained The Business Book Hardcover Walmart Com Livro De Negocios Grandes Ideias Livros De Negocios

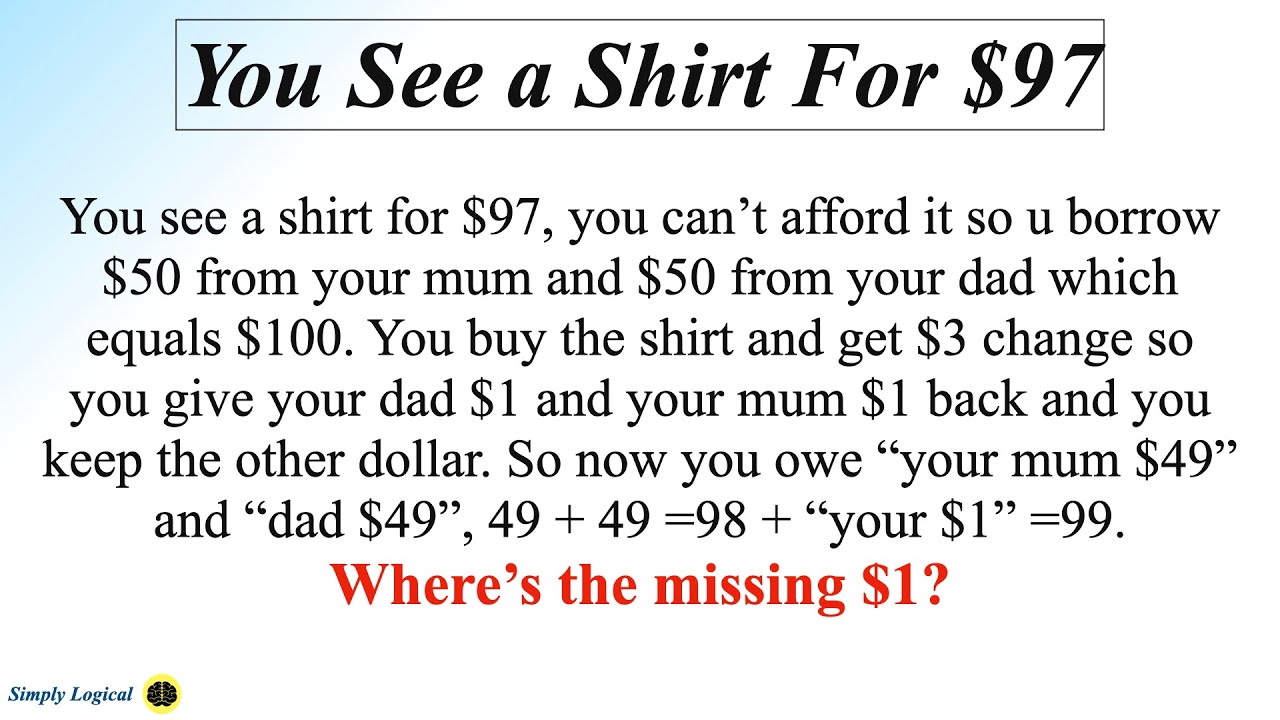

You See A Shirt For 97 Riddle You See A Shirt For 97 Riddle Riddles Brain Teasers Shirts

99 Stock Market Terms Every Good Trader Investor Knows Stock Market Cash Flow Statement Stock Market Investing

All The Ins Outs And How To S Of Life Insurance Simplified And Explained For You Life Insurance Life Insurance Marketing

Real Estate Pros Explained Real Estate Broker Real Estate Professionals Real Estate Agent

Wedding Traditions With A Modern Spin Posted Fete Something Blue Wedding Something Blue Bridal Old New Borrowed Blue

What Is Quantitative Easing And How Will It Affect You European Investment Bank Real Estate Investment Fund Investing

A Visual Explanation Of Spoon Theory Spoonie Chronicillness Spoon Theory Spoon Theory Explained Fibromyalgia

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Personal Finance Budget Money Concepts Money Management Advice

Free Read The Business Book Big Ideas Simply Explained Business Books Dk Publishing Got Books

Worksheet Wednesday Wordless Wednesday 7 9 14 Nouns And Verbs Multiple Meaning Words Nouns And Verbs Worksheets

Pin By Jj On Conventions Shadowhunters It Cast Borrow Money

We Owe History The Dignity Of Context On Twitter John Key You Have Two Cows Cool Words

1000 Opposite Words In English Antonyms List Opposite Words English Opposite Words Words

Difference Between Lend And Borrow Learn English With Harry Learn English Advanced English Vocabulary English Language Learning

Time Value Of Money In 2022 Time Value Of Money Money Concepts Money Change